The cryptocurrency market has been a hot topic recently, and it's no surprise given its explosive growth and ever-changing dynamics. Over the past 10 weeks, the market's capitalization metric has followed a relatively narrow upward channel, suggesting that bullish momentum remains strong. However, it's important to note that this momentum has faced challenges in breaking above the critical $1.7-trillion market cap resistance.

December saw significant developments in the cryptocurrency world, with Bitcoin (BTC) hitting 20-month highs above $44,000 and Ether (ETH) experiencing an upswing, reaching up to $2,400 before encountering resistance. Amidst these price surges, some analysts have raised concerns about excessive demand for leveraged long positions, speculating that it may trigger a correction. In this blog post, we'll delve into these developments, analyze market trends, and assess whether a correction is looming.

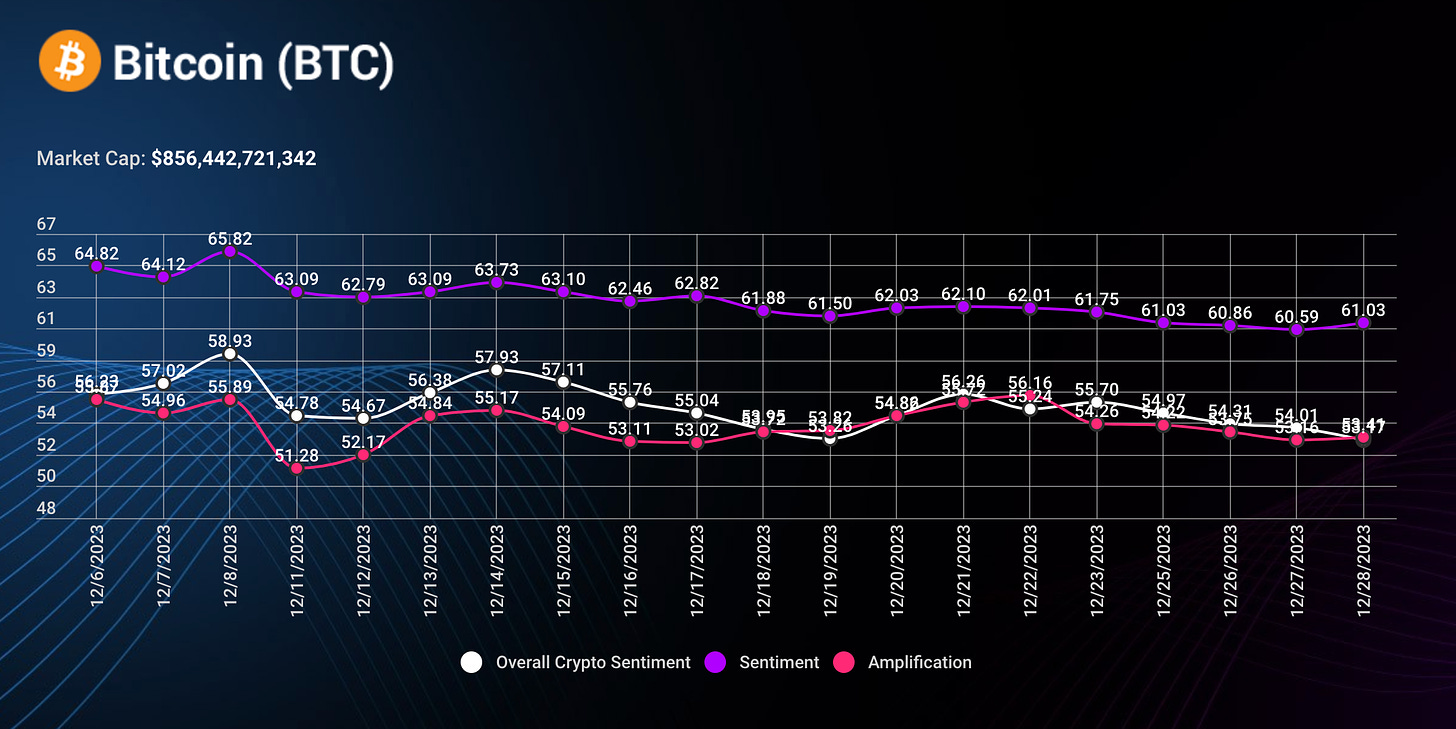

Bitcoin Sentiment dropping under the overall in December could be tracking into a bearish position for early January, however recent action is holding a very close comparison on the overall market sentiment vs Bitcoin amplification sentiment. Notice the correction of of Amplification from a 51.28 on December 11th vs the current trend.

Analyzing the Bullish Momentum:

BTC's Impressive Surge: Bitcoin's price action has been remarkable, with BTC reaching levels above $44,000 in December. This surge has been driven by a combination of factors, including institutional adoption, increased interest from retail investors, and growing recognition as a store of value. The continued support for Bitcoin has contributed significantly to the overall market capitalization.

Potential Factors for Correction:

While the cryptocurrency market remains bullish, there are concerns regarding the possibility of a correction. One key factor contributing to these concerns is the surge in leveraged long positions. Traders taking on excessive leverage can amplify market volatility, potentially leading to sharp price corrections.

Predictions and Future Outlook:

Predicting the future of cryptocurrency markets is challenging due to their inherent volatility and susceptibility to various external factors. While there are concerns about excessive leverage and the potential for a correction, it's essential to consider other factors such as continued institutional interest, regulatory developments, and macroeconomic trends.

In conclusion, the cryptocurrency market's recent performance has been impressive, with Bitcoin and Ether reaching significant milestones. However, the market's sensitivity to leverage and potential regulatory changes warrant caution. Traders and investors should closely monitor market developments, diversify their portfolios, and prepare for bullish rallies and potential corrections in this dynamic landscape.

Our gift to you - THE BEST DEAL OF THE YEAR!

Become a Diamond Circle Member FREE! ➜ https://bit.ly/PBDiamondCircle

Market Sentiment Index ➜ https://bit.ly/MarketSentimentIndex

Subscribe on YouTube ✅ https://bit.ly/PBNYoutubeSubscribe

Facebook 📱 https://bit.ly/PBNfacebook

X/Twitter 📱 http://bit.ly/PBNtwitter

Looking for the best tax havens for Crypto? Free Month with iTrust Capital - Use PROMO CODE - PAUL BARRON https://rebrand.ly/PAULBARRONDisclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Cryptocurrency investments carry risks, and individuals should conduct their own research before making investment decisions.

Analyzing the Cryptocurrency Market: Bullish Momentum and Potential Corrections