The FED Could Break To a Pivot After Powell's Remarks

Fed Meeting vs. Crypto and Recession Sentiment

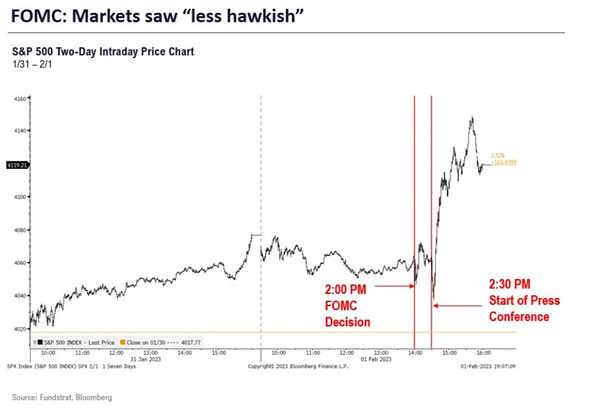

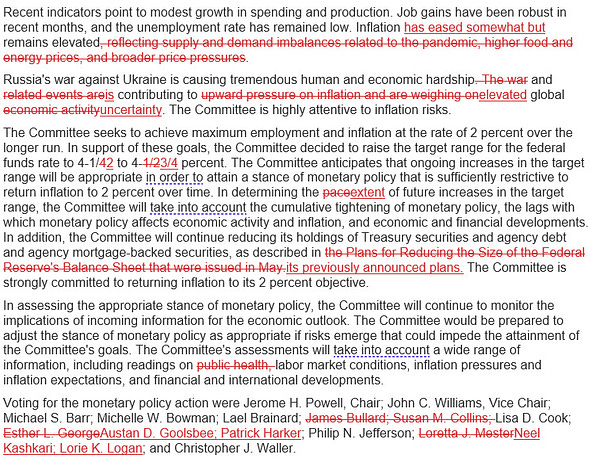

The Federal Reserve raises interest rates .25 basis points for the eighth time in 11 months at the conclusion of its first monetary policy meeting of 2023 on Wednesday. The meeting also marks a pivotal turning point for the Feds’ decision-making: a return to normal.

My overview is looking at the macro effect of the economy in the short term which could put Bitcoin into a new price zone based on the lack of key triggers that may not cause future Fed action. Chair Powell’s soft responses almost to the point of a soft pivot played out into today’s meeting.

BONUS ANALYSIS

What are the Key Things to follow for the next few weeks and months?

The jobs report on Friday this week will have a big impact, but our research shows strong job numbers and we anticipate a slight downtrend which will merge with the thoughts from Powell today.

Long-term sentiment on Bitcoin, this is the strongest sentiment data we have seen since BTC's last bull moves prior to the all-time high in 2021.

The fact Chair Powell believes five percent inflation could be the new target zone for a potential pivot, based on trends this could occur as early as May or June.

#fomc #fedmeeting #crypto ~Fed Meeting vs. Crypto LIVE! Recession Sentiment Analysis~